(translated from: “Cristiano Ronaldo cobró de Nike, KFC, Toyota y Konami a través de una sociedad de Irlanda”, El Confidencial, Thursday 1 December 2016, Jose Maria Olmo and Jesus Escudero, http://www.elconfidencial.com/espana/2016-12-01/cristiano-ronaldo-football-leaks-derechos-imagen-mim-limited-irlanda_1297213/)

– The Real Madrid star closed sponsor deals with multinationals using a company resident in the Eurozone country with the lowest corporate tax

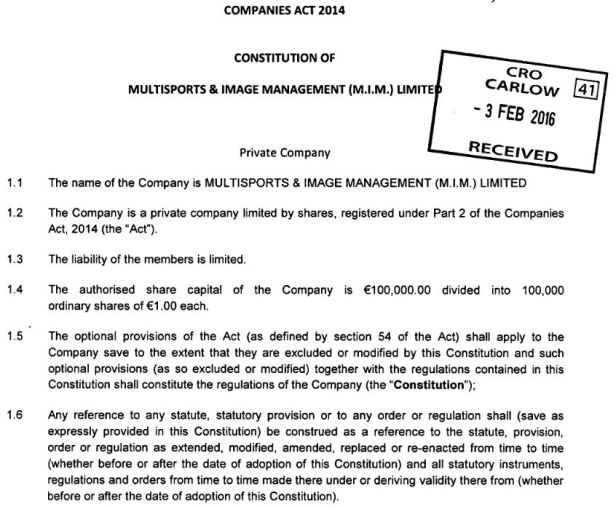

Cristiano Ronaldo has used for years an Irish company – Multisports & Image Management (MIM) Limited – to exploit his image rights and channel the millions he gets for them. The Real Madrid forward used the company to negotiate the conditions and sign the contracts with all the major brands that have chosen him to promote his products, according to documents revealed by ‘Football Leaks’ that EL CONFIDENCIAL has had access to. Among those deals are those that have led Ronaldo to participate in campaigns of Nike, Unilever, Kentucky Fried Chicken (KFC), Konami and Toyota Thailand, among other multinationals.

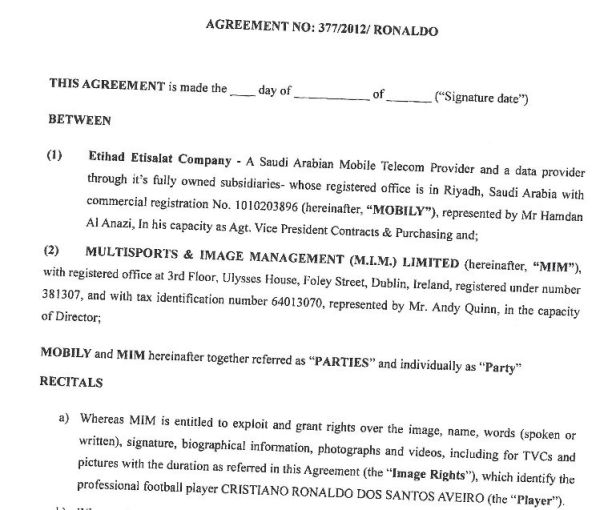

MIM Limited was founded in 2004 and has its headquarters in an office building in the center of Dublin. Andy Quinn, an Irish lawyer born in 1967 with no apparent connection to the Portuguese star, is in charge of the company. However, confidential agreements of MIM Limited signed by Quinn in 2012 confirm that the company is “authorized to exploit and grant rights on the image, name, words (spoken or written), signature, biographical information, photographs and videos (…) that identify professional football player Cristiano Ronaldo Dos Santos Aveiro”, the full name of the Real Madrid goalscorer.

The name of that company not only appears in secret documents. In September 2015, Cristiano launched his own brand of fragrances and cosmetics for men. On the official website that markets his products, it is admitted in the legal terms section that Cristiano Ronaldo and Cristiano Ronaldo Legacy are registered trademarks owned by MIM Limited that have been assigned to Eden Perfumes Limited to manufacture them.

The abundant information that Football Leaks unveiled in 2015 includes two contracts of MIM Limited with corporations for which the player carried out advertising and promotional events in 2013 and 2014. More specifically, these are the agreements with the American jewelry firm Jacob & Co and Saudi Arabian mobile phone company Mobily, a subsidiary of Etihad Etisalat Company. In addition, the Portuguese newspaper ‘Correo da Manhá’ published in May 2015 that Banco Espírito Santo (BES) had hired the Real Madrid forward for several advertising campaigns, also through MIM Limited.

What was not known until now is that the star of the Portuguese team also used this company located in Dublin to sign all agreements with the main brands to which he lends his image. Thus, according to the Football Leaks contracts, Cristiano turned to MIM Limited to agree on the terms and remuneration for advertising and wearing Nike products, the Clear shampoo of British-Dutch giant Unilever, the video game ‘Pro Evolution Soccer’ by the Japanese developer Konami, a car marketed by Toyota in Thailand and US-based fast-food chain Kentucky Fried Chicken (KFC), in addition to the already unveiled deals with Banco Espirito Santo, Jacob & Co. and Mobily.

The tax advantages of using a company registered in Ireland to obtain image rights are obvious. It is the country in the eurozone with the lowest corporate tax, barely 12.5%, half of that in Spain. The Spanish tax agency usually questions that the image rights are charged through a country other than the country of residence but, also, that they are obtained through a company. In their opinion, they are returns that must be take counted for the personal income tax. That is to say, if the tax agency were right, because of the volume of the contracts and bearing in mind that the forward from Madeira lives in Madrid, he would need to have paid 43.5% in taxes of what he got for transferring his image rights,, 31% more than what is paid in Ireland.

Ireland is officially not a tax haven but, according to experts, the country in reality belongs to that category because of its very low corporate tax. But it is not necessary to resort to a tax haven for such structures to be investigated by the tax authorities. The State Attorney, representing the Tax Agency, asks for Cameroon player Samuel Eto’o (Real Madrid, Real Mallorca and FC Barcelona) to be sentenced to 10 years in prison and a penalty of 68,86 million (including the fine) for simulating a transfer of his image rights between 2006 and 2009 to Tradesport and Marketing Kft, a company located in Hungary, a territory that is not officially a tax haven. “Income attributed to the Hungarian company is taxed at a particularly low rate, ranging from 10% to 19%, possibly even 3% for certain non-resident companies that do not have any economic activity in the country”, the State Attorney concludes in its text. Most of these revenues whose taxation is questioned by the tax authorities came from sports brand Puma.

The African striker resided in Spain in that period, as did Cristiano Ronaldo during the years in which the advertising agreements signed by MIM Limited were in force. At least in the contract with the mobile subsidiary of Etihad Etisalat Company, a clause even establishes that the employment relationship “is governed and enforced in accordance with Spanish law”. “The parties agree to be bound and subject to the jurisdiction of the courts of the city of Madrid, Spain, for the purposes of any dispute between the parties on the interpretation or execution of this agreement or any other arbitral ruling,” according to the document to which this newspaper had access.

Industry sources explain that if Ronaldo has declared in Spain to own the shares of the Irish company, it is usual for the tax authorities to pursue the case only by administrative means and, if the Tax Agency is successful, the file would be closed with the payment of the disputed fees and an economic penalty. But if he has not even declared his relation with the company, the procedure against the Real Madrid player for a possible tax fraud could go through the criminal court, if the amount defrauded exceeds the minimum of 120,000 euros per year needed to impute a crime against the treasury.

Un portavoz oficial de Cristiano ha asegurado a El Confidencial que el jugador “se encuentra al corriente de todas sus obligaciones fiscales desde el inicio de su carrera, como podrá certificar la Agencia Tributaria en España, y cualquiera de los países en los que ha residido”. Las mismas fuentes subrayan que Ronaldo “no está ni ha estado jamás implicado en ningún problema con la autoridades fiscales de país alguno” y que “todos sus derechos han sido gestionados de acuerdo a la legislación vigente”.

An official spokesman for Cristiano told EL CONFIDENCIAL that the player “is aware of all his tax obligations since the beginning of his career, as the tax authorities in Spain, and in any of the countries in which he has resided, may certfify” . The same sources stress that Ronaldo “is not and has never been involved in any problem with the tax authorities of any country” and that “all his rights have been managed in accordance with the current legislation.”

In June 2015, Cristiano announced that he had sold 50% of his image rights to Singapore tycoon Peter Lim, owner of Valencia CF. He assured it was a “strategic move” to try to grow, especially in the Asian market. More specifically, the new owner is Mint Media. The other 50% is owned by Real Madrid.

Read also other translations :

– Cristiano diverted at least 150 million to a tax haven to hide image rights revenue

– Cristiano Ronaldo’s lawyers : “This scheme is a huge problem for the player”

(translated from: “Cristiano Ronaldo cobró de Nike, KFC, Toyota y Konami a través de una sociedad de Irlanda”, El Confidencial, Thursday 1 December 2016, Jose Maria Olmo and Jesus Escudero, http://www.elconfidencial.com/espana/2016-12-01/cristiano-ronaldo-football-leaks-derechos-imagen-mim-limited-irlanda_1297213/)