(translated from: “Cristiano desvió a un paraíso fiscal al menos 150 millones para ocultar ingresos por derechos de imagen”, El Mundo, Saturday 3 December 2016, Paula Guisado and Javier Sanchez, http://www.elmundo.es/deportes/football-leaks/2016/12/02/5841d852468aeb61028b462b.html)

– The Portuguese, focus of scrutiny, as revealed by EL MUNDO as member of the European network EIC, based upon the investigation of the Football Leaks documents obtained by German magazine “Der Spiegel”

– He used three companies in a Caribbean tax haven to collect his advertising revenue

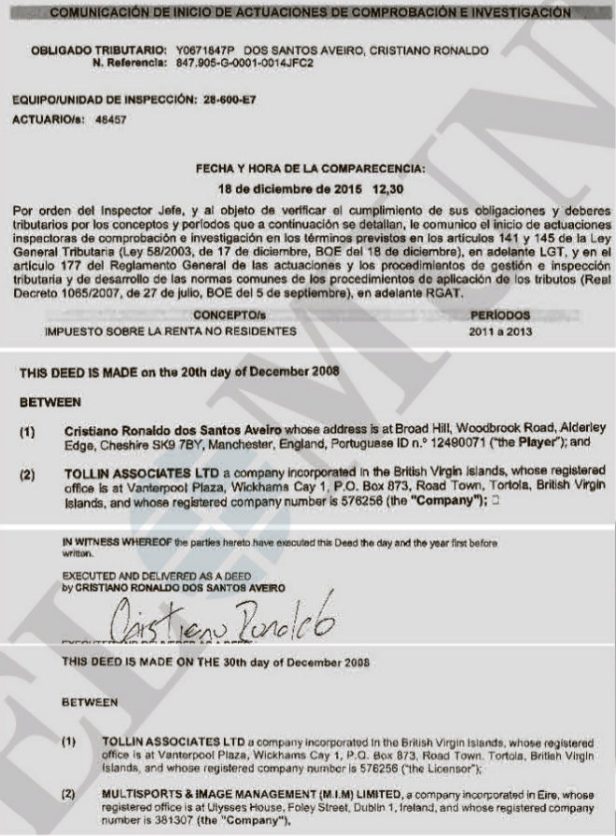

– Tax authorities started a year ago an investigation on his income tax revenues from 2011, 2012 and 2013

Ghost companies, tax havens, investigations by tax authorities, fiscal engineering by the best law firms,… The dark side of football. And now Cristiano Ronaldo, the upcoming four-time Ballon d’Or winner, takes center stage.

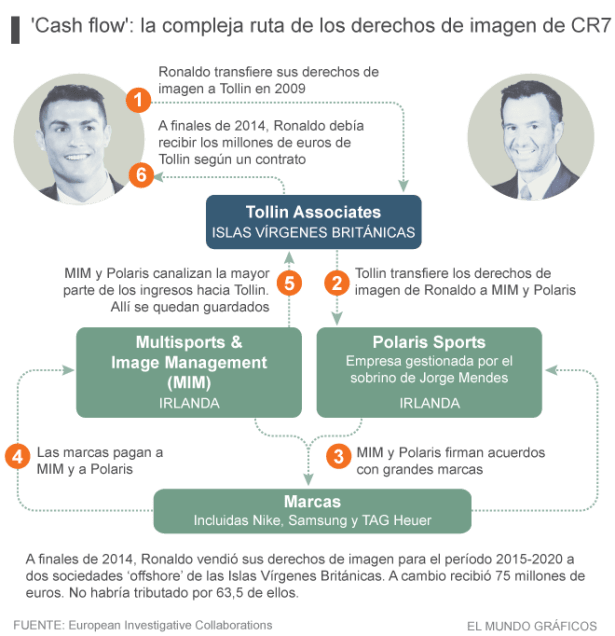

Since the start of 2009, months before his arrival at Real Madrid, Ronaldo stored his image right revenues in several companies on the British Virgin Islands, a tax haven in the Caribbean. These companies worked with an own obscure scheme of companies with no real activity, no employees and operating through professional front men.

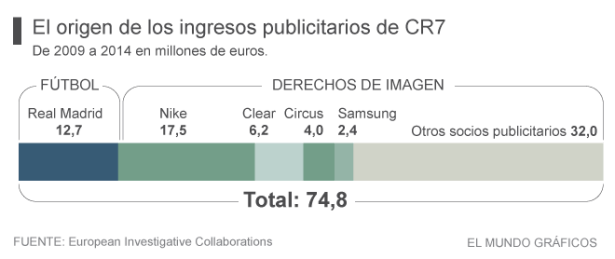

For the first six years, Tollin Associates, a company located at a post office box in the city of Road Town, protected his 74,8 million in advertising revenues. In 2015, two other Caribbean companies in the same tax haven and with the same address as Tollin, Adifore Finance and Arnel Services, bought his image rights until 2020 for another 75 million. The operation was carried out through Mint Capital, a company linked to businessman Peter Lim, and the money ended up on a Swiss bank account of the player.

Ronaldo thus generated almost 150 million euros advertising revenue and, due to the lack of transparency of the scheme, initially only paid 5,6 million of that – less than 4% – directly to the Spanish tax authorities.

Moreover, he did it in one operation, in his declaration for 2014. The end of the privileges for the athletes under the “Beckham Law”, combined with the worries about the inspections of the clients of Mendes by the tax authorities, caused them to change their strategy head over heels and try to regularize his situation.

‘Cash Flow’: The Complex Route of the Image Rights of CR7

1) Ronaldo transfers his image rights to Tollin in 2009, 2) Tollin transfers the image rights of Ronaldo to MIM (Multisports and image Management – Ireland) and Polaris (Polaris Sports – Company managed by the nephew of Jorge Mendes – Ireland), 3) MIM and Polaris sign deals with big brands (Including Nike, Samsung and TAG Heuer), 4) The brands pay MIM and Polaris, 5) MIM and Polaris channel the main part of the revenues to Tollin, where they are stored, 6) At the end of 2014, Ronaldo should receive millions of euros from Tollin according to a contrtact

In his tax return of that year, the Portuguese gave the tax authorities a little insight in his offshore scheme and exposed the method of tax avoidance used by Jorge Mendes’ clients: the money goes through Ireland – the most similar to a tax haven in the European Union -, is managed in the tax haven British Virgin Islands and ends up on bank accounts in Switzerland.

As a result, exactly one year ago, on December 3th 2015, the tax authorities started an investigation on the Real Madrid star. After investigating dozens of players, they opened an inquiry against Ronaldo for possible irregularities in his Non-Resident Income Tax (IRNR) returns for the years 2011, 2012 and 2013. The focus is on the image rights and there’s a bigger risk for the star: that they enquire into the whole offshore structure.

The forward’s scheme has a starting date, 20 December 2008. On that day, he formally transfers his right to Tollin Associates, a company registered in a building at Vanterpool Plaza, in the city of Road Town on the British Virgin Islands. Six months before 80 000 fans filled the Santiago Bernabeu stadium to celebrate his arrival at Real Madrid, Ronaldo created the first of his schemes.

From 1 January 2009 through 31 December 2014, Tollin was the depository of the exploitation of his image rights. The player was mentioned as the recipient of “all income received by the company”, except for 20 000 euros per year and possible management costs. And, also, except for the part of the companies controlled by Jorge Mendes. Because a few days later, Tollin transferred 100% of the exploitation of these image rights to two companies of the agent’s network in Dublin, Multisports & Image Management (MIM) and Polaris Sports, and gave both between 24% and 26.5% of the player’s annual advertising revenues. These were the commissions of the agent.

With this structure, Mendes squeezed out the tax advantages for his benefit and that of his clients. On the one hand, he took advantage of the low taxation in Ireland to pay only a 12.5% tax on the benefits of MIM and Polaris. On the other, he used the opacity of the British Virgin Islands to hide the advertising revenues of his players from the eyes of the tax inspectors.

In the case of Ronaldo, moreover, the agent exploited to the limit the possibilities of the so-called Beckham Law, a norm in force since 2005 to attract highly qualified managers and staff and that could be used by athletes until 2015. The rule offered foreigners in Spain to be taxed as non-residents, meaning that it allowed them to only pay taxes for the income obtained in the country and at a fixed rate of 24.75%, compared to the maximum of 48% paid on the high incomes of the residents.

Taking advantage of this legislation, Mendes’s partners, with the help of their lawyers in Spain, the Senn Ferrero law firm, estimated that, regarding the 74.8 million gained from advertising deals between 2009 and 2014, Ronaldo only had to pay taxes on 20% of some contracts. The rest were considered to be income generated abroad. The Football Leaks documents only mention tax payments for these amounts in 2014, five years after his transfer to Real Madrid.

Morocco. 20 December 2014. Real Madrid wins the Club World Cup in Marrakech. The end of a fiscal era is approaching for the still inpatriated Ronaldo, but the advisers of the player, Jorge Mendes and his partners, have an ace up their sleeve: their second offshore scheme.

The 2014 change

Without waiting for 2014 to end, just before the transition period of the Beckham Law was terminated, Mendes reorganizes the scheme of his most important client. Ronaldo’s image rights, until 2014 deposited at Tollin, are sold as a whole for the following six years, until December 31th 2020. And they are divided between two companies established in the British Virgin Islands. Revenue regarding the exploitation at a global level, about 80 per cent, is allocated to Adifore. The revenues linked to Spain, approximately the remaining 20%, are transferred to Arnel. And regarding both parts, Mendes manages, through Polaris, to stay in charge of the contract and to get between 10% and 15% of some operations.

The same 20 December, Ronaldo sends an invoice to each of the two companies that, according to his lawyers, are controlled by businessman Peter Lim, owner of Valencia: 63,7 million invoice to Adifore and an 11,2 million one to Arnel. In total, nearly 75 million in advertising revenue for six years, from 2015 to 2020.

The Source of CR7’s Advertising Revenues – from 2009 to 2014 in million euros

FOOTBALL Real Madrid 12,7 IMAGE RIGHTS Nike 17,5 Clear 6,2 Circus 4,0 Samsung 2,4 Other advertising partners 32,0 TOTAL 74,8

That is to say, the image rights are fixed at the same amount as the revenues in the previous six years. And once transferred to the companies in the Caribbean, the radar of the Spanish tax authorities becomes less effective. The 75 million billed to companies linked to Lim ended up in Geneva, Switzerland, at bank account number 413416 in the name of Ronaldo with the exclusive Mirabaud bank. Just in time for the player to only have to pay the amount allegedly produced in Spain, approximately 15%. For that part, he would only be taxed at 24,75% – rate in force until 31 December 2014 -, almost half of what would have been the maximum rate.

The income tax return of 2014 is the key. Because of the end of the Beckham Law, it was the last chance for Ronaldo to enjoy from his non-resident status. In addition, the tax authorities put pressure on Mendes. It was the ideal time to try to cover up his situation.

In that return, submitted at the end of the season, on 30 June 2015, the player paid at once taxes on the Tollin part: the 11,5 million euros coming from the subjective 20% he would have obtained for advertising in Spain between 2009 and 2014. And at the same time, he declared the new structure with Arnel: the 11,2 million, supposedly the part linked to Spain of the 75 million received for his image rights between 2015 and 2020.

In total, in 2014 he paid taxes on 22,7 million of the 150 million received for advertising in 12 years, with a final payment to the tax authorities of 5,6 million. Meaning that for his image rights between 2009 and 2020, he paid hardly 4% of what he generated. And it was thanks to a double strategy: the free interpretation of how many of his contracts he should declare and for how much; and the benefit of paying taxes on the declared amount for 24,75%.

The investigation by the Spanish tax authorities

For now, the investigation by the tax agency is only focusing on the years 2011, 2012 and 2013. According to sources contacted by EL MUNDO, the tax authorities could identify several possible irregularities at this stage. “Ronaldo should have declared Tollin’s money year by year since 2009, not all at once in 2014,” says the prestigious lawyer Rafael Villena, founding partner of the WZR law firm, “besides that, they shouldn’t have allowed him that year to pay taxes on his income for 2015 through 2020. I can not see how a tax authority accepts this as normal. ” Lawyer Peter Duvinage, a representative of athletes, agrees. “If during the investigation of a scheme, a company from a tax haven pops up, all alarms should go off.”

Thus, against the background of inspections of other clients of Mendes and players like Messi, Mascherano or Xabi Alonso, the problem for Ronaldo is not that the tax agency deems that he has paid less than needed and imposes an fine. The question is whether they will look into the entire offshore scheme and will demand him to take responsibility for it.

“We succeeded in preventing the tax auhorities from considering that the companies that deal with MIM, in this case Tallin (sic), are owned by the players. That does not matter to them, thank God,”, the lawyers celebrated, knowing that the real ownership of the scheme could be the big problem for Ronaldo. At the beginning of his case, the documents show that the tax agency failed to completely uncover the fiscal structure of the player. Contacted by EL MUNDO, they did not want to reveal if they in the end succeeded in doing so. According to his lawyer in Spain, Julio Senn, the enquiry “is open and, for now, at the investigation stage”. Gestifute says that “Cristiano Ronaldo is up to date on his tax obligations in Spain”.

Read also other translations :

– Cristiano Ronaldo’s lawyers : “This scheme is a huge problem for the player”

– Cristiano Ronaldo got paid by Nike, KFC, Toyota and Konami through a company in Ireland

(translated from: “Cristiano desvió a un paraíso fiscal al menos 150 millones para ocultar ingresos por derechos de imagen”, El Mundo, Saturday 3 December 2016, Paula Guisado and Javier Sanchez, http://www.elmundo.es/deportes/football-leaks/2016/12/02/5841d852468aeb61028b462b.html)